Office slips again - along with MSFT's credibility

I hadn't even gotten around to trying out the newly announced Office 2007 test drive preview, when lo and behold MSFT announces that Office 2007 will slip once again. See coverage here:

I hadn't even gotten around to trying out the newly announced Office 2007 test drive preview, when lo and behold MSFT announces that Office 2007 will slip once again. See coverage here:

Here's the essence of his argument:

It's bad enough that Microsoft is getting in to all aspects of security. But now they are going to kill their competition through predatory pricing.

Predatory pricing is the practice of a dominant firm selling a product at a loss in order to drive some or all competitors out of the market, or create a barrier to entry into the market for potential new competitors.

Alex contends--and I would agree--"that Microsoft is endangering the entire security ecosystem."

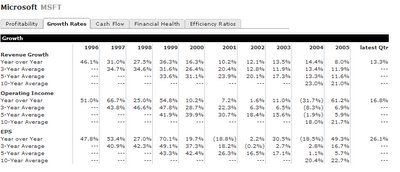

Microsoft is just one of a bunch of giant large-cap companies that have been delivering stellar financial results but have elicited nothing but yawns from Wall Street. This is hardly Ballmer's fault. IBM, Time Warner, and Home Depot are other examples. Profit growth seems not to matter.

...fantastic job on every measure.

Utzschneider admitted that MBS had struggled to integrate its new acquisitions, blaming "indecisive leadership" for its struggles."Indecisive leadership"? Whoa there big fella! At MSFT? Now, it's unclear who he's referring to exactly (maybe he has some political smarts after all) but since he credits "better overall leadership" under Orlanda Ayala, one gets the impression that it could be former MBS head Doug Burgum - who in the Alice in Wonderland upside-down world that is MSFT executive accountability, got promoted to Chairman of course. In any event, I give credit to Utzschneider for doing more than either Ballmer or Raikes and that's state the obvious: MBS has been poorly led and that has resulted in years of false starts and missed opportunity. When MSFT first entered this arena in 2001, I didn't buy into Jeff Raikes' asinine "MBS will be a $10 billion division by 2010" fantasy, but I did think MBS offered to most obvious payback of any of the so-called "emerging businesses". Which is why I have been deeply dissapointed by the constant screwups and excuses in the intervening years while folks like Salesforce.com and Rightnow have been on fire and even industry giant SAP has been putting up better growth numbers. The good news is that MBS finally seems to be on the right track and may start consistently contributing to the bottom line versus detracting from it. I still question the growth rate of 25-28% as that isn't anywhere close to either Salesforce.com or Rightnow and seems insufficient to take share against any of the main competitors in the space - which is what the goal should be and what SPSA bonuses should be judged against.

Microsoft has demonstrated a practice of using its monopoly power to undermine cross platform technologies and constrain innovation that threatens its monopolies. Microsoft’s approach has been to “embrace and extend” standards that do not come from Microsoft. Adobe’s concern is that Microsoft will fragment and possibly degrade existing and established standards, including PDF, while using its monopoly power to introduce Microsoft-controlled alternatives – such as XPS. The long-term impact of this kind of behavior is that consumers are ultimately left with fewer choices.

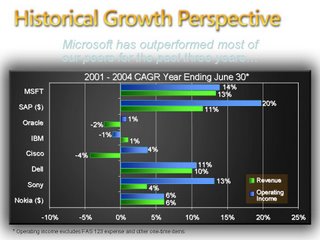

In July of 2004, John Connors (then MSFT CFO), presented the following slide in a presentation to financial analysts:

To see the full slide deck and/or read the presentation transcript, click here.

The basic message was that the company had outperformed many of its peers on key financial metrics such as revenue and operating income. Now you could argue that MSFT's near-monopoly and massive recurring revenue was a huge relative advantage in the aftermath of the 2000 technology bust, but that's a seperate debate. In fact, I'm not bringing up the slide to fault the analysis or John Connors for making it; it was a reasonable point and Connors was a very capable CFO who's subsequent departure imo was a big loss to MSFT (and perhaps foreshadowed some of the current messs). The reason I bring up the slide is that it was one of the first times that MSFT provided its own view of who it should be compared to.

Keep in mind that at the time, MSFT has already underperformed most of these names badly from a stock perspective - a fact that was conveniently omitted from the analysis. Today, of course, it's company MO not to mention the stock or even go as far as Ballmer's ridiculous “We have never really used the stock market itself as a barometer of our success” uttered at the last shareholder meeting no less. But I thought it would be interesting to see how MSFT's stock performance has compared to these names two years later.

Using a 5-year chart, MSFT is down approximately 40% (yes, I'm leaving off the incredibly stupid $3 one-time and collective dividends). Here's how the rest of the list has done:

In other words, MSFT has underperformed not just some of them, but ALL of them. But wait, it gets worse. Inquiring minds might note that even in 2004, that list was pretty self-serving and excluded obvious competitors like Salesforce.com, Google, Yahoo, Redhat, and Apple. How have those folks done over the past 5 years?:

Oh, and the NASDAQ itself over that period? Flat (0%).

Bottom line, 40% underperformance versus the index, lagged every one of its self-selected peers and wasn't even in the same league as several of its most formidable competitors. I give that a score of "F" for fail and only because miserable failure isn't available.

Okay, so we're all pretty much used to this by now - unfortunately. But if you missed the latest, it appears that Adobe and MSFT are having a spat over how MSFT will include support for Adobe's PDF format in Office 2007. Needless to say, this could spill over to the EU where Adobe has already raised concerns and where regulators are, shall we say, predisposed to lending a sympathetic ear to all complaints MSFT-related.

Various media links here:

Microsoft's Brian Jones gives his seemingly reasonable perspective here:

I'm not going to wade into this one further until I hear Adobe's side of things. Off the top, it does seem like Adobe is trying to treat MSFT differently than they have other folks like OpenOffice and Apple. And while I can appreciate that the potential impact from lost sales in the MSFT case is much more substantial, it occurs to me that they should have considered that possible development when they offered up PDF as an "open standard" in the first place. That said, I can't help but think that MSFT's increasingly competitive approach with partners, especially Adobe of late, has probably contributed to getting Adobe management's back up. Jupiter Research's Joe Wilcox has made that point repeatedly on his Microsoft Monitor weblog and I think he's right. At a time when all for-profit software vendors face increasing competition from Open Source, you'd think common sense might argue for them to work more closely with each other to enhance to overall value proposition for customers. Apparently not. For Wilcox's take on this specific mess, see his post here:

On a brighter note, if it does end up going to court but the facts are as laid out by Brian Jones, maybe MSFT's legal team might have a shot at actually winning one for a change? But that's another post...

Media coverage was extensive, but the most insightful article imo was this one by Mitch Ratcliffe:

He brings up several interesting points. One that I've wondered about for a long time is what exactly MSFT's massive $7B/annual R&D spend represents? According to Ballmer, only about $250M is actual "R" leaving $6.5B of "D". Is that simply operational product development costs masquerading as R&D for tax purposes? If so, it's pretty concerning wrt to what the true [non-variable] costs of MSFT's product development might be. It also calls into question whether Ballmer should be touting it as the massive differentiator that he does. Anyway, if someone has some insight into how that $6.5B is seperate from general product development, I'd be interested.

A second comment he makes is critical imo:

The really cogent argument Ballmer did offer for the reliance on internally developed technologies and products was XBox. He pointed out that, if Microsoft had acquired Nintendo (whose U.S. headquarters is just down the street and now surrounded by Microsoft's campus), it would have spent three to four times as much as it will lose in the early years of XBox and "we would have had a business we didn't understand as well, wasn't as good, wasn't as well-positioned and essentially would have cost our shareholders an additional $6 billion, $8 billion." All true, yet it doesn't seem to inform Ballmer's strategic approach to extending Microsoft's business.

If the build-it-don't-buy-it case is proven by XBox, Ballmer should be much stronger in his defense of Microsoft's $35 billion cash reserve, more of which should be going into basic research now to put the company at an advantage later.

Exactly! If Ballmer believes that the massive investments he's made over the past 5 years have been wise for shareholders, then he needs to articulate that and in some detail - in particular because these emerging businesses as a group are still collectively unprofitable and detracting from earnings and hence the current stock price. His unwillingness to do so suggests that he can't because he doesn't know the answer, or that he won't because he knows the answer might not be sufficiently compelling to convince investors that it was a good risk/reward. IMO, it's more likely the latter, although I'm still willing to give Ballmer the benefit of the doubt. However, until he comes across with some detail, investors will view all the new "investments" through the prism of this past track record and conclude that it simply means more big dollars being spent upfront for unclear future returns.