By the numbers

As mentioned in a previous post, during the transition announcement yesterday, Gates said of Ballmer that as CEO "he's done a fantastic job by every measure". I took specific issue with that in the post, because it ignores the massive multi-year underperformance of the stock. However, whether it's even true on just a pure financial basis is worthy of debate.

Here's some data from MorningStar which may be difficult to read and can be found here:

This first table details overall profitability. Reviewing the numbers and in particular comparing the period '00 (the year Ballmer took over as CEO) to '05, things that jump out include a good job keeping gross margins stratospheric (83.7% vs 86.9%), but a whopping 44% increase in SG&A which has contributed to a 24% decrease in operating margin . The trend in both did improve materially in '05 vs '04, but the net result is a company that is far less profitable today on a net basis that it was in '00. This is key, and completely at odds with Gates' further statement yesterday that MSFT "had doubled sales and profits" during that period. Sales, yes. Profit, at least on a net basis, not even close.

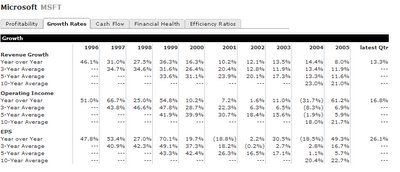

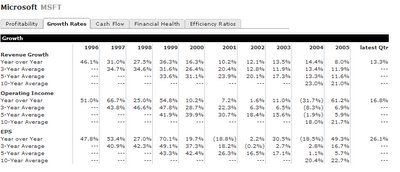

This second table details growth rates. In addition to the massive slowdown in revenue growth that we're all aware of, note the lack of consistency in either operating income and - critical to the stock - EPS. Once again, '05 brought some promising improvement in raw numbers, but based on next year's surprise spending plans, we'll once again see a huge variable move down in EPS growth.

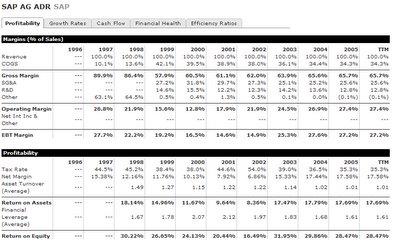

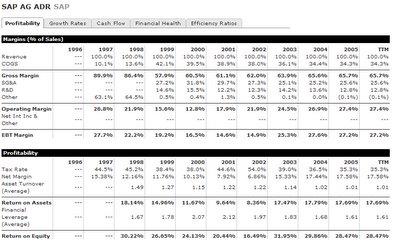

If you're wondering how this compares to MSFT's peers, here's the first one I pulled - SAP:

Looking at the period '00 - '05, we have gross margin up 8.5%, and operating margin up a whopping 53%. I guess their CEO must have done a "super fantastic" job.

Here's some data from MorningStar which may be difficult to read and can be found here:

This first table details overall profitability. Reviewing the numbers and in particular comparing the period '00 (the year Ballmer took over as CEO) to '05, things that jump out include a good job keeping gross margins stratospheric (83.7% vs 86.9%), but a whopping 44% increase in SG&A which has contributed to a 24% decrease in operating margin . The trend in both did improve materially in '05 vs '04, but the net result is a company that is far less profitable today on a net basis that it was in '00. This is key, and completely at odds with Gates' further statement yesterday that MSFT "had doubled sales and profits" during that period. Sales, yes. Profit, at least on a net basis, not even close.

This second table details growth rates. In addition to the massive slowdown in revenue growth that we're all aware of, note the lack of consistency in either operating income and - critical to the stock - EPS. Once again, '05 brought some promising improvement in raw numbers, but based on next year's surprise spending plans, we'll once again see a huge variable move down in EPS growth.

If you're wondering how this compares to MSFT's peers, here's the first one I pulled - SAP:

Looking at the period '00 - '05, we have gross margin up 8.5%, and operating margin up a whopping 53%. I guess their CEO must have done a "super fantastic" job.

2 Comments:

You have to remember that NO ONE, SAP INCLUDED is directly comparable to Microsoft. Microsoft is a profit machine. No matter what the stock price does, they are making money.

Start planning long term, and you will see that MSFT has taken some hits today to hopefully increase profits in the future.

That's pretty good for a company that has essentially saturated its markets.

By Anonymous, at 5:13 PM

Anonymous, at 5:13 PM

margin is one part of the financial picture. The reality is that the SGA is driven by the increasing complexity of the products we are now selling "aftermarket" - MBS, Exchange, RTC etc, Office Servers. SGA is just going to be way more expensive for those than selling oem versions of Windows. Decline in op margin percentages simply reflect the much faster growth of those businesses than the core franchise of single user desktop software. Are those businesses we want to be in? Of course. At the end of the day you take margin dollars over percentages.

Hint: look at cash flow from operating activities and benchmark that against the peers....

By Anonymous, at 7:19 PM

Anonymous, at 7:19 PM

Post a Comment

<< Home