Too close to call

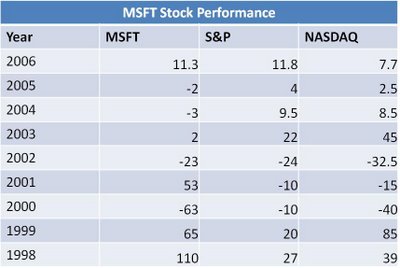

Regardless of whether MSFT missed or beat the S&P this year, it's close, and most investors (as opposed to traders) measure performance over something more than simply a one-year period. To assist in that, I took some numbers from Investor.msn for the period 1998-2006. Note: these are eye-balled approximations using the default closing numbers and don't include dividends - though given MSFT's lousy below-market dividend, that actually benefits them in most years but '04 (the year they paid the massively-stupid $3 one-time). Here's the result:

What's your take on that track record of performance? You already know mine. How many of you out there could underperform your peers by almost 50% over a 3-4 year period and still retain your job? I suspect very few, but apparently Ballmer et al are working under different constraints than the rest of us. Maybe he had an advance agreement with the Board to take this decade off and just forgot to inform shareholders? :-)

More importantly, what does '07 hold? Fortunately or unfortunately, the bulk of the failed-tender related buyback needed to be completed by year-end ['06] in order to reduce the share base sufficiently to make the revised yearly numbers (which had been bumped up on expectations that the tender would complete). Therefore, a good part of that catalyst should disappear or at least diminish come January. That still leaves the increased regular buyback ($20B), which may or may not be used in '07. If so, that might help. But as we've seen over the past 4 years, even $10B's of buybacks haven't been able to do much more than provide support. Oh, and let insiders trip over themselves cashing out ridiculously generous pay packages at higher prices (than would likely have prevailed otherwise), while telling us what a great job they're doing on our behalf.

The real determinant in '07 will therefore be the general market backdrop (a rising tide lifts all boats, as they say). Also critical, will be MSFT's ability to finally start driving some meaningful bottom line earnings acceleration in excess of what the street already expects. Personally, I don't see that occurring in '07 unless Office and Vista really take off (longshot - at least in '07), MSFT sandbagged the impact of the generally higher-priced Vista skus and accelerated accounting recognition (likely), or the company finally gets serious about cutting headcount following the Office/Vista launch (much needed, but doubtful). As always, any surprise "good news" from all the money-losing divisions would also be constructive - like say a profit.

Personally, I saw some signs this year that MSFT's management is finally acknowledging - or being forced to acknowledge - the need for substantial change. While that's almost 5 years later that it should have been, better late than never. However, if they continue making changes at the current glacial pace, then MSFT's best days are definitely behind it.

On a related note, Joe Wilcox has some advice for MSFT heading into 2007:

My list would be somewhat different, and I might actually do one for a future post. In the meantime, he makes some good points and it's worth a read.