For want of a shoe, or time for a new rider?

A MSFT-employee recently challenged me to discuss what I would change at Microsoft. I have provided that commentary many times over dozens of posts on a topic-by-topic basis. However, doing it as a subject unto itself is new - and pretty daunting given a company the size and scope of MSFT (Indeed, as you'll see, I think that breadth is one of MSFT's major problems). There is also the immediate issue of determining whether you think the problems are a result of strategic shortcomings, or tactical ones. For example, while Benjamin Franklin was undoubtedly correct when he said:

“A little neglect may breed great mischief: for want of a nail the shoe was lost; for want of a shoe the horse was lost; and for want of a horse the rider was lost.”

It's also true that the right rider can make all the difference in the world. A relatively recent case in point: HP under Mark Hurd versus Carly Fiorina. While I was no Fiorina fan, given the rapid turnaround, it now seems apparent that the company must have been in better shape under her tenure than it appeared to be at the time - but it took Hurd to bring that out.

So, let's begin with the strategic:

Mission

MSFT does not appear to have a clear, honestly customer-focused mission that is understood at all levels. Importantly - and perhaps as a result - employees seemingly aren't in total accord or fully bought into it. If MSFT truly believes in "Your potential. Our passion", then it needs to do more than just pay lip-service to it. It needs to open itself to all that that entails (cross-platform support, not playing lock-in games, etc.) and deliver against it. If they do that, then most employees probably would be fully on board (i.e. maybe the problem is the current gulf between words and actions). Those that wouldn't be, need to go.

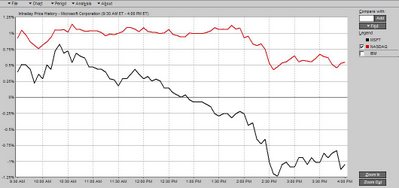

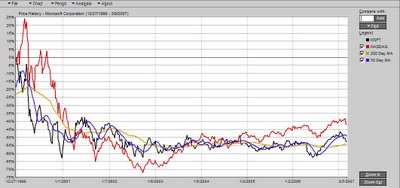

Leadership

Seven years have passed since Ballmer took over as CEO, and that's more than enough time to make a fair assessment of his performance in the role and suitability to continue. While he's off the charts for passion and desire, and has done a good job growing the top line (and, much less successfully, the bottom one), overall it's been a mixed bag at best, and abysmal at worst. In particular, I think Ballmer lost the confidence of the street - and maybe employees too - long ago. In my view, it's therefore time for a change. Moreover, it's time for an external hire to fill the role. MSFT needs someone with a fresh perspective, versus someone closely intertwined with the past and what used to work. Assuming Hurd can't be lured over from HP (which is probably true), Oracle's Safra Catz or YHOO's Susan Decker might be good candidates. But I don't mind if that new CEO has a previous MSFT pedigree. That may even be wise, especially if the individual saw what was coming more clearly and, in classic MSFT politics, got pushed out for making too many waves. Brad Silverberg, for example, comes to mind (interestingly, he was also one of the financial backers in Tellme, which MSFT recently acquired). Perhaps there are others even more suitable.

Culture

I see two concerns here. First, the need to move from a culture of "good enough" to one of "excellence" and "insanely great". I've posted about this before. MSFT has a long-standing approach, ingrained via Gates, of getting something - anything - out to market and then fixing it over time. That worked well for a long time when "free" alternatives weren't prevalent, and when competitors/markets weren't moving as quickly as they are today. Now, it's a lot less successful, and yet MSFT continues to do it and be surprised when it fails. This is an area where Apple's Jobs seems to get it, while MSFT appears clueless (and no, I'm not a MAC fanboy - just calling it as I see it). The second area of concern, reported in many sources and evidenced in comments on Mini-MSFT, is MSFT's "cult of personality" versus a true meritocracy. This is truly dysfunctional, and seems to have resulted too often in the wrong people getting ahead or staying, while other [more capable] individuals have been passed over, left, or been forced out. Again, it's impossible to ignore that the culture which currently exists requires Ballmer's tacit approval, if not his full support. It needs to end and ergo, again, he needs to go.

Training

What is MSFT's process for ongoing training and development? Does it exist? Especially within the leadership ranks, it appears to be ineffective or non-existent. Microsoft should put more cycles into trying to create a successful management development curriculum patterned after GE's highly regarded program. Obviously, it will have to be customized, but it's not a coincidence that many, many former GE senior executives go on to be CEOs of other major corporations. How many ex-MSFT senior executives have done that? One, if we count Rob Glaser at RealNetworks? Maybe this process has begun - I don't know, but the results aren't yet evident in overall execution.

Rewards and Punishment

MSFT's reward structure seems to be inconsistent, inequitable and disconnected from the things that drive shareholder value. A leadership team who misses their own earnings goals, for example, should not be eligible to earn 100%+ of their $1B SPSA bonus payout - period. While each group should have metrics that are unique to their business, certain core objectives - like earnings -should span all units and act as global multipliers. In other words, miss your earnings objective, and your entire bonus will be impacted regardless of how well you did on other non-core metrics. MSFT also needs to review the skew between the "top 500" - now morphed to 800 or more given MSFT's ongoing bloat - and everyone else. IMO, it's unjustifiably high. Since overall results don't support increasing the size of the pie, it's time to start allocating it more evenly with those who actually do the bulk of the work. Finally, punishment goes hand in hand with accountability. Sadly, it's been non-existent - at least at MSFT's executive levels - for most of this decade. Recently, we've seen some improvement there, but even then it's often late and mired in uncertainty (e.g. was the executive fired or did they quit?). Punishments, like rewards, should be clear, timely, and leave little doubt about why they're being doled out

Prioritize/Focus

Stop fighting major wars on multiple fronts simultaneously. It is simply ridiculous for current management to assume that MSFT can fight the biggest and best companies on earth, across a dozen or more battlegrounds, and still hope to prevail. Just take a look at some of the folks MSFT is going up against: SONY (and Nintendo) in gaming, Nokia and many others in mobile, GOOG and YHOO in Search, Everyone from Alcatel to Siemens in IPTV, IBM/Oracle/SAP (and smaller players Salesforce.com. Rightnow, etc.) in ERP and CRM, IBM/Adobe/FOSS in middleware and development, AAPL and most of MSFT's former partners in mobile media, AAPL and GNU/Linux in Operating Systems, and FOSS in personal productivity. Worse, these battles are spreading MSFT too thin, and leaving its core cash cows increasingly vulnerable (would Vista have taken 5 years to develop if management hadn't been distracted with a dozen other battles?). MSFT needs to prioritize the current list down to something more realistic, while ensuring that the appropriate vigilance is maintained on the crown jewels. As a start, any new battle should require them to give up an existing one. Notice how that NEVER happens and they're always additive instead?

Better together

Put "partnering" back in Platform. Windows and Office (to a lesser extent) have been successful historically not just because they were decent products, but because they provided a platform for others to develop on. Today, MSFT is increasingly competing against many of its former partners. If you were SAP right now, would you be putting more resources into Windows/SQL/Office, or looking to Linux/mySQL/OpenOffice? Where is Adobe putting an increasing amount of its efforts now that MSFT is competing against them in numerous categories? Ditto, CSCO? Ditto, far too many suppliers imo. If Windows and Office - not to mention most "for-profit" s/w offerings - are going to continue to succeed against increasingly functional low or no cost alternatives, its going to be on the overall platform experience and not the features of any one product. Otherwise, it's just a matter of when, not if, OSS alternatives become good enough in each category to supplant the incumbent (some argue they already are).

For-profit suppliers need to wake up to this bigger threat, and MSFT needs to get back to its roots of providing developers with the preeminent platform for adding value to other's solutions - not cherry picking them off one by one when they establish a market that gets large enough to attract MSFT's competitive interest. I'd also like to see more cross-promotions of mainstream offerings (i.e. not bundled "craplets"), and a global Window-update equivalent (like Linux/FOSS has via "apt-get" and associated GUI front-ends like the Synaptic package installer). Does it really make sense to have half a dozen separate updaters running on my PC - each with its own GUI, process and quirks? If there's a Windows anti-trust concern, make it a Live service. While you're at it, throw up a Live service to clean the craplets off new PCs automagically - the out-of-box customer experience there is terrible (yes, this is primarily an OEM-initiated problem, but since they're not economically inclined to fix it, offer a service which does - it's in MSFT's best interest).

The LBU - Linux Business Unit

Yup, time to face the music and stop pretending Linux isn't here to stay. Not only is it, it's likely to eventually gain a significant share of global desktops (read: eventually much more than AAPL). So why is MSFT resisting it so hard versus simply embracing it as yet another opportunity to sell software a la the Mac Business Unit? IMO, MSFT should be focused on what it can still sell accounts who go this route. At a minimum, that could include Servers for legacy support of Windows apps. But maybe MSFT should even develop it's own "customer-friendly" linux distro (or, if GPL exposure of that code is an issue, maybe a non-GPL licensed library to run on any distro, or a BSD-based distro)? BTW, if they haven't taken steps to at least determine the engineering feasibility of that and effort required, then they're not doing their job. Additionally, why make it a religious battle? Like any OS, Linux does some things very well. For one, it's much more modular than Windows. So why not empower an internal group to promote it where it might make sense - like say in a set-top box or audio device? The Novell SUSE distribution thing is a step in the right direction, but MSFT needs to do more. Heck, if it can't convince itself that the Windows kernel and architecture is superior - and I can't find a single analysis that argues that's the case (company published or otherwise - if you have one btw, I'd be interested in a link) - maybe it should do an AAPL, hop on board a Mach/BSD kernel, and add value at higher levels only moving forward?

Investments that make money

Duh, you say? Well consider that despite years - or in some cases decades - of effort and $10B's spent, MSFT's emerging business "bets" are STILL collectively unprofitable. Business can and do make investments for a variety of reasons. These include generating an ongoing stream of earnings, creating a asset which can be sold to realize a profit, protecting an existing earnings stream, and ensuring access to a future one. MSFT's problem is that almost all have been sold to shareholders and the market as the first, but have failed miserably to provide a return. While execution blunders and other mistakes have normally been a contributing factor, it's becoming increasingly apparently that either management plans to ignore that, or their actual goal was always defensive versus offensive and they simply misrepresented their original intent. IMO, either of those options is unacceptable.

Research and Development

MSFT spends a ridiculous amount of money on R&D - as they're happy to point out at every opportunity. How much? About $35B since 2000 (more than IBM, and more than SONY/GOOG/AAPL combined). What they don't like to talk about, is how little of that is the "R" part (only $500M or so annually). In other words, it's mostly development costs masquerading as R&D for tax purposes and to maintain the fantasy that maybe it's mostly discretionary. More importantly, like the "investments" above, you rarely hear details on the return being generated. Either MSFT needs to figure out a way to better tap the ideas coming out of the MSR brain trust, or maybe it's time to disband that group like Apple did. Someone then needs to look at that overall Development cost and figure out why it's so large. To put it in perspective, AAPL has spent less than $5B on R&D since 2000, yet doesn't appear to be lacking for either innovation or development. Indeed, they seem to be kicking MSFT's butt at both, resulting in larger returns, much quicker paybacks, and faster growth. Fixing this obvious imbalance, would likely be the biggest single contribution to accelerating earnings that any new CEO could make.

Mergers and acquisitions

MSFT's track record in this area is mixed to horrible. In most cases, the acquired company's products have either disappeared completely or been incorporated into some other offering. Additionally, the size and scale of these acquisitions have been very modest relative to MSFT's size and cash position. IMO, that's overly-conservative. I've posted before that MSFT could - and should - have done more at the bottom of the dotcom/market bust when the who's who of technology were trading at pennies on the dollar. I view this as one of the largest single mistakes of Ballmer's entire tenure - and there's no shortage to choose from. Even today, he is routinely quoted as stating a preference for many small acquisitions versus a larger one. Then why carry that much cash on the Balance Sheet? Is MSFT a bank? While larger purchases bring with them more integration risk, and MSFT hasn't exactly blazed a trail of success on smaller ones, companies like HPQ and Oracle are demonstrating that the widely-held industry perception of larger acquisitions "never working out", may not be true. As a result, I think MSFT needs to get more aggressive in this area and better at it. The recent Tellme acquisition is a positive step in the right direction - at least it's bolder. But MSFT needs to figure out how to successfully leverage new acquisitions a la the recent EMC/VMware model, versus doing their usual borgify and ultimately destroy. Again, one of the core strengths of a new CEO should be a demonstrated track record of M&A success.

A truly global structure

Don't just talk globally, act globally. While growth is increasingly shifting to emerging markets, and MSFT talks up the opportunity, it continues to be hugely Redmond-centric. Yes, the company has established some foreign labs, etc., in recent years, but it still pales by comparison to the market opportunity or similar large global entities like IBM or HPQ. MSFT sells decentralized computing but acts more like a mainframe. Time to push more and more operations overseas where the growth is, and where the greater talent pool exists. IMO, had MSFT done more of this sooner - like in Europe, for example - they also wouldn't be perceived as such a US-entity, and would be better embraced by foreign markets (and especially Governments) as part of the local community.

Oh, and freeze Redmond headcount (except for select strategic initiatives) for at least the next two years.

Marketing/Sales

Marketing and Sales needs to become world-class. I'm not sure MSFT ever was a leading marketing or sales organization - although in the 90's, when things were all going the company's way, the perception was that they were incredible. Frankly, I think IBM, Oracle, HPQ, SUN, etc. were always significantly more experienced in selling to the enterprise and maintaining high-level relationships. And in the consumer space, which is increasingly important, MSFT is getting beaten hands down by AAPL and many others. Again, that needs to change. On the consumer side, MSFT needs a new advertising company pronto and/or new executive oversight. For every one good ad/campaign, there are ten bad ones. They also need help with product design, packaging and especially naming. On the enterprise side, I'm not sure whether the solution is new training, new recruitment, or new leadership - probably all of them.

Public Face

I am sick and tired of MSFT executives "trash" talking competitors in public. This is such a fundamental business tenet that it's an embarrassment to have to even list it. But Ballmer and Gates were apparently asleep the day everyone else learned it. Moreover, others throughout the organization appear to key on this and feel empowered to do likewise. It needs to stop and asap. Be judged by your products, support, and execution - not your mouth.

Put the fun back into computing

Somewhere along the line, MSFT seems to have fallen into the IBM trap of trying to please corporate IT departments instead of users. To do so, imo, is to forget the lessons of Windows 95. Windows 95 was a hit not because IT departments demanded it - they didn't. It was a hit because users embraced it and then demanded it at work. I recently loaded Vista, which I may post about, and liked it overall. But there was very little "Wow" - certainly not enough to justify upgrading my existing machine and purchasing the retail version to get it. Which makes the advertising campaign that much more ridiculous. Underpromise and overdeliver - another basic business tenet that MSFT routinely ignores. My advice? Get a feature pack (and not just a service pack) out asap. Beyond that, get back to making computing fun for users.

Okay, now on to the more tactical:

Windows

Sending in Sinofsky to clean house and get this division back on track, was smart and way overdue. IMO, Allchin and others should have been fired during the Vista reset fiasco - but undoubtedly Gates fingerprints were so prevalent in that screwup that sending others packing would have been the height of hypocrisy. As above, I think Vista is just "good". So much for Ballmer's "It'll be great - bet on it". That's pretty unacceptable after all the time and money spent, and it's going to make it that much harder to sell (all PR puff pieces about exceeding initial XP sales aside). Stepping back, I think the writing is on the wall that MSFT needs to develop a cloud-type hybrid OS that lives on both the desktop and server. Others already are, via companies like this (sporting ex-MSFT distinguished engineer Lou Perazzoli, and ex-CFO John Connors as an investor) or via technologies that promise a similar experience - like Adobe's Apollo. It would be nice to think that MSFT is way ahead of the game on this, especially given how core it is to the business and how far along others appear to be. Sadly, based on this and this, it sounds like they're late to the party yet again.

I also think MSFT has to decide whether it can continue to compete while dragging several decades of legacy code with it. Backwards compatibility is something that MSFT can be justifiably proud of. But moving forward, I don't see how the company can keep up with AAPL and Linux with the current code base. Pretty obviously, MSFT needs to be in a position where it can come to market much faster with new releases than it has done. In particular, I think it needs a consumer release that is a perpetual showcase for innovation. This addresses the more "fashion" orientated demands of this increasingly important market segment and, like Windows 95, would keep IT departments on their toes via end-user demand. All due deference to the more modular approach of Vista, I just don't see that being sufficient to enable this. Now, I don't profess to have the technical answers here, but all options - from new "cloud" OS, to dropping some legacy compatability and/or embracing a new kernel and leveraging higher-value layers only (like OS X) - should be on the table.

Business Division

Now that Raikes has finally woken up to former GE CEO Jack Welch's "when you think you've reached saturation, expand the market definition", I think the Office group is on the right track. If they can do a good job of that via telephony, etc. then justifying the additional cost of Office should be viable - assuming you get the world-class Salesforce in place that I discussed above. I also applaud the boldness of the new "ribbon" interface. I haven't completely made up my mind on it, but that took guts. Kudos.

On the ERP/CRM side (formerly BusSol), I think this group will never be the market leader as long as its mandate is polluted by trying to be an Office-delivery mechanism versus the world's leading ERP/CRM solution. In my mind, now that the moronic decision to go head-to-heard against previous partners has been made, this group should be free to pursue that objective 100%, including supporting OpenOffice front-ends, non-SQL RDBMS, etc., when and where that becomes desirable (if it isn't already).

Finally, given the renewed focus on Healthcare (which I agree with), I would seriously consider buying a large Healthcare software supplier that would be accretive - like Cerner. If you're wondering about the apparent contradiction there, I don't see that being as aggressively confrontational versus existing partners as were say, the ERP/CRM moves.

Server & Tools

This is a group that imo can be justifiably proud of their record of accomplishment. Yes, SQL suffered a huge delay. Yes, Exchange faces some imminent threats from OSS and needs to get easier to manage for larger entities. Yes, Home Server has some work to do. But quarter in, quarter out, this group has an excellent track record of profitable growth despite being in the direct line of fire from Open Source alternatives. It's going to take a lot to stay that way and adjust to the whole SAS model, but they seem up to the task.

Online Services

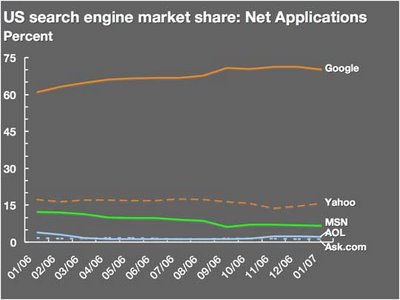

Let's face it, MSN has been an abject failure. Indeed, outside of IPTV and MSFT's $10B of failed cable investments, no other group in MSFT has burned through more cash, over a longer period, and still had losses to show for it. WRT the more recent efforts here in Search and Advertising, those too have been massive failures. Again, that's not just my assessment - it's the assessment of professional analysts whose opinions I have quoted on several occasions. As a result - and as I posted here - I think MSFT should give the current team until year-end to show the beginning of a turnaround. Recent monthly stats provide some reason for optimism in that regard (the ongoing market share losses having been arrested, at least temporarily), and I have confidence in at least Berkowitz. But if they can't show progress by then, it's time to pull the plug and outsource the entire effort to YHOO in return for a % of the action.

Entertainment and Devices

Why is MSFT in the device market? If they are going to be in it, shouldn't there be a plan to be #1? If so, why didn't they buy Logitech at some point? I mean, if you're going to tank overall margins with hardware anyway via Xbox, why not do it with something profitable? WRT that bigger concern - Xbox, what can I say that I haven't said repeatedly before? It will likely take multiple decades, if ever, for MSFT to recoup the $5B+ expended on Xbox to date. Additionally, it would be hard to find a buyer given that profit picture and the massive losses generated on each console rev. I also think MSFT's current management has no intention of selling it. As a result, Xbox is a financial failure by any reasonable overall assessment. That said, the $5B is now a sunk cost, and if leadership is convinced that future losses can be mitigated and a [ongoing] profit generated, then it makes sense to continue forward. Gaming is big business overall and I think MSFT needs to be represented. It should just have been done in other ways, and imo MSFT stupidly neglected the PC-gaming market in the interim (an oversight which, thankfully, appears to be getting addressed). What doesn't make sense is to pretend that Xbox has been a success or even a "great success", or to give the executives involved - many of whom are the same geniuses who predicted 2-3 year paybacks back in 2001 - more responsibility. Oops - too late - Zune.

Conclusion

Those are some of the issues as I see them - strategically and tactically. Again, I don't profess to have extra insight, nor do I think I have all the answers - or even any of them. At the same time, I'm not splitting $1B in bonuses with 800 other senior colleagues because of my supposed world-class brilliance. What I am, is a shareholder who has held an underperforming stock for this entire decade, while the current management team has been telling me to "have patience, our plan is working". It isn't, and it's time for someone new to come in, acknowledge that fact, and start making the tough choices required to get things back on track - or at least fail trying.

Update: Various articles that touch on the themes here in some way (i.e. directly or indirectly):

- Microsoft's Tech Summit: Redmond Still Trying To 'Get' Open-Source Software

- Where Is Microsoft Search?

- Microsoft Research: Great Ideas, Where Are The Products?

- Microsoft First Notified Of .ANI Bug In December

- Tech Analysis: Windows Vista Sucks Performance

- Microsoft hints at Zune phone as market share falls

- Buy internet groups when they empower user base