I've fallen and I can't get up

"Given the series: $31-$30-$29-$28, what might logically come next?"

Today, several reporting services (NASDAQ, Investor, etc.) have a low on MSFT of $26.60 - although the charts suggest that might have been a bum trade and it was really around $27.27. Regardless, we're close to the "$27" I had implied in the quote above. It also came amid an escalating slide relative to not just itself, but the market. MSFT has now clearly disconnected from the latter, forming what is called a "negative divergence". That does not bode well.

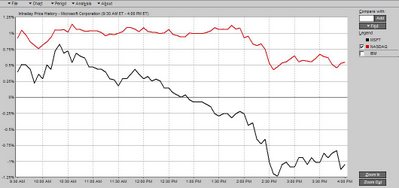

On a daily basis, I track some 20 stocks. For most of today, only two were negative - MOT and MSFT (though that has moved to 5 by EOD). Here's the chart for MSFT:

Note: that's actually a bit off due to timing/charting issues on Investor. MSFT actually closed down more than 1.05% in a market that was up .55%. And it came on above-average volume - again, not good.

In that same post, I went on to say that:

While I'd like to be more constructive, there's no denying that MSFT's chart is now completely broken technically and screaming "Sell". A full 1/3 retracement of the June '06 to Jan '07 run has been completed and yet the stock is still showing no signs of firming. So if the market continues rolling over, odds favor MSFT eventually testing (and likely dropping) the 200 day moving average which is currently sitting at $26.78. If things get really bad, expect a full 2/3 retracement to ~$24.74. But hey, look on the bright side: by then, the dividend yield will be closer to market.

It's still unclear whether the market is going to find support here or not (and we're getting close the "sell in May and go away" adage), but I stand by my earlier assessment. If MSFT can't find some relative strength here ASAP (like tomorrow - which will be tough given that it's a Friday), it is definitely at risk of dropping its 200-day moving average - and convincingly so. Based on the continued and even accelerating weakness, the market seems to know something we don't. Is more bad news on the way?

BTW, quoting my previous comments isn't being done to say "good call Extrememakeover". First of all, I've made plenty of bad calls. Second, that's not my style. Third, I'm sickened for all shareholders who have once again seen the value of their holdings plummet - myself included. I offer them up instead, merely to provide a context against which you can judge my current comments, as well as on the off-chance there's anything of value for your own MSFT investment strategy.

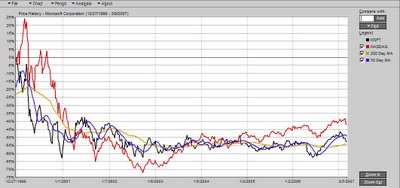

Now, any stock can have a bad day. This isn't about that - so save me the comment complaint. The chart above, however, would yield the same net result - underperformance versus the NASDAQ - if currently drawn over:

- 5 days

- 10 days

- 1 month

- YTD

- 3 months

- 1 year

- 2 years

- 3 years

- 4 years

- 5 years

- 6 years

If you don't believe me, try it yourself (posting separate charts would have taken too much space). In fact, let's look at how the stock has performed this entire decade so far:

BTW, the red line is the NASDAQ and the black one is MSFT - in case it's not easy to read.

An employee commenter recently suggested we should all be used to this by now, and wondered why I'm harping on it. The former is obviously true, but I reject the logic implicit in the latter. As investor owners, it is our right to communicate our dissatisfaction with current management's track-record. In particular, because that record is one of abject failure to drive realizable shareholder value - as detailed above. In fact, as a shareholder, I'm embarrassed that we haven't been more vocal (as a group) in expressing our concerns. Had we done so earlier, changes might have occurred, and we might not have gone this decade (so far) underperforming the market. But sadly, much of MSFT is held by large institutions who, unlike you and me, can invest in complicated hedging strategies to mitigate the underperformance or even benefit from it. Many are also forced to hold MSFT because they track the indexes in which it is a prominent member (especially the S&P). However, there are signs that even this group may be tiring of holding a stock with such an abysmal performance record - they actually being rated on their results.

Of course, the usual Ballmer apologists will come out of the woodwork and talk about the need for "patience". They'll talk about how you have to focus on "managing the business" not "managing the stock". The more analytically inclined, will add that MSFT got too expensive during the late 90's (at least when growth subsequently fell off a cliff), and that this extended period of stagnation has been about "restoring fair value" or "growing into its market cap". Still others - convinced this is all an anti-MSFT conspiracy - will tell you it's because the market just "hates" MSFT and is therefore ignoring what Ballmer has managed to accomplish. And then there's the company's many detractors, who will wade in with "Duh, the company's best days are behind it" or, more likely, something less eloquent and more juvenile like "that criminal, monopolist felon M$ is screwed". There's at least an element of truth in most of these. However, I don't think any of them goes to the heart of the matter.

WRT "patience", that argument is getting pretty tired by now (see above if you're confused). It's also worth noting that, when it came to his own personal investment in Six Flags, Gates himself didn't seem to put much faith in "patience" as an investing premise. WRT focusing on managing the company not the stock, that's clearly true, but then the visible business results of that strategy haven't been overly evident, have they? WRT the "overvaluation" argument, that could be said of most tech stocks in the late 90's (MSFT even missed out on much of the final blowoff because concerns over the DOJ trial were already rising), and yet many have outperformed MSFT in the period since, including Oracle, HPQ, AAPL (don't even look, you'll depress yourself) and many, many others. WRT the conspiracy theory, why "MSFT" (although it is a lightning rod for critics - perhaps a message there), and then why isn't this borne out in the valuation measures? MSFT may be cheaper than some, but it is by no means "cheap" relative to growth, sales, earnings or many other measures. WRT MSFT's "best days" being over, I don't think that's true by definition, but it certainly seems increasingly plausible given the current trajectory. Still, there are numerous other companies who this could be said of, and yet they've still managed to outperform MSFT since '00 - and handily. Example: IBM.

While many of the above have played a role (and add in all the legal fallout), I think MSFT stock has underperformed for several - mostly objective - reasons. In order, these are:

- the failure to drive earnings commensurate with revenue (most of the post '00 growth having been of the profitless variety). IMO, this is far and away the #1 reason. To date, Ballmer's "emerging bets" have cost shareholders billions in cash and foregone earnings while collectively failing to pay off at all.

- a perception, based on demonstrated execution failures, of a company that is getting weaker versus stronger, and less agile versus more so. Again, many of these are demonstrable and even in supposedly "core" areas of expertise (e.g. Longhorn/Vista).

- a concern that competition is getting fiercer and that MSFT is increasingly fighting battles on too many fronts, against too many players, and losing many of them.

- a dawning realization that technology is once again going through a major tsunami, coupled with a belief that MSFT is more concerned with avoiding being crushed - or even denying its existence - rather than adapting quickly enough to catch the wave and eventually lead it.

- a management team that comes across as largely oblivious to all of this, and by their actions, have made it clear that they are unwilling and/or unable to change course regardless of impact on the business or other stakeholders - especially shareholders.

As a result, the street is losing confidence and - since they figure they can't affect a change of leadership given Gates' and Ballmer's stakes - voting with their feet. That process began when MSFT first disconnected from the market in 2003, and it continues. So far, based on results, the market - and not Ballmer - got it right. Which is why I get irritated - and frankly, insulted - when I read a comment in this article. In it, CFO Chris Liddell discusses MSFT's acquisition strategy. FWIW, on that score, I completely disagree that MSFT couldn't and shouldn't have done more numerous and larger acquisitions (except that they generally suck at it, but that shortcoming needs to be addressed pronto). In fact, when you consider that at the depth of the bear market most companies were trading for pennies on the dollar, and MSFT had the largest cash horde of anyone, why didn't they buy more? Likely a combo of being conservative by nature, but also totally distracted by the anti-trust legal fallout. That's a shame, because it could have been a once-in-a-lifetime home run for shareholders by now. Nevertheless, it's not Liddell's overview and justification of their approach that bothers me, and he even makes a few decent counterpoints. It's this:

It's ironic that we can probably get more of a pass from our shareholders at spending $5 billion on an acquisition if there's a very strong short-term impact than having a $2 billion R&D spend over the next three years, which may have the same impact.

Chris, did you accidentally swallow the [Matrix's] blue pill instead of the red one? If so, wake up and face the truth. It's not ironic at all. It's a reflection of the pathetic track-record of driving shareholder value that I've discussed above. Against that backdrop, shareholders are naturally more inclined to give you a "pass" on doing something - anything - new, versus continuing to do what clearly hasn't worked for shareholders this entire DECADE. Indeed, why you and the rest of the management team assume you don't have to justify a continuation of business-as-usual and your previous/current/future investments, and are seemingly taken aback when you are even asked to do so, is really the only thing that is ironic - or just plain ignorant.

Update: 3/13/07 - The 200-day moving average was officially broken today. Despite the extreme selloff YTD, the stock still managed to end on its low, underperforming the NASDAQ - again - in the process. News about another potential DOJ investigation didn't help, and the market didn't appear to like the potential Tellme acquisition. Next likely stop is low $26's or high $25's. If that doesn't hold, the 2/3 retracement level mentioned in the post - $24.74 - would be the next logical target.

8 Comments:

Chances are the market is getting sensitive for the opportunity Vista provides to reevaluate the purchasing decisions wrt Microsoft's products, as in

http://www.informationweek.com/news/showArticle.jhtml?articleID=197800480

By Anonymous, at 4:58 PM

Anonymous, at 4:58 PM

Yes, it's a concern - especially given the extra hardware requirements for Vista and of course the availability of alternatives like "free" Linux and even OSX. It's still early days, but MSFT needs to do a better job of combatting the negative Vista fallout from lack of drivers, app incompatibilities, etc., and a much better job of telling the story for "why upgrade?". Outside of store end-caps and the occasional Vista TV ad, I've seen very little. Where are the success stories? The positive reviews? The $500M media campaign? The cool new partner apps?

By MSFTextrememakeover, at 6:52 PM

MSFTextrememakeover, at 6:52 PM

On acquisitions...what surprises me is the drive to "integrate" them so deeply. I'm not sure that an acquisition of Yahoo! (do like the options in your previous post) wouldn't be better run like as in a holding company. If the point is to drive shareholder value, it's all about the revenue. In that case we should look into just running bigger things, or even profitable smaller companies, as a holding company and just let them do their own thing, that they do well. You do some lightweight integration around making sure that the technology is platform compatible, scrub for legal and let it run separately. We tend to "Borg-ify" too much and that tends to slow things down as well as destroy the value in the acquisition. And having been on the forefront of one of our acquisitions last year, it also destroys the morale of very energetic human acquisitions.

By Anonymous, at 7:55 PM

Anonymous, at 7:55 PM

Good thoughts. Yes, MSFT needs to figure out a way to get the VMware/EMC-style ST synergies w/o sacrificing their LT product roadmap or (more often) snuffing out the newly acquired company in bureaucracy and process.

By MSFTextrememakeover, at 12:14 AM

MSFTextrememakeover, at 12:14 AM

I made the "used to it" comment in response to the renewed sense of frustration in each new post of yours. My point was to get used to the frustration, not the poor performance.

I certainly never come to this blog expecting a glowing review of MSFT stock, but I'm always surprised at the amount of enthusiastic negativity you produce with each post.

I like you comments, and would like to see your take on 2 things:

1. Why do you still own the stock if you're constantly frustrated by it?

2. What would you change about the company today if you could? For example, Xbox was a bad investment, but is it now a bad thing to have?

My (few month old) take on the stock valuation is here:

http://briankramp.spaces.live.com/blog/cns!FB414355CC45FFEB!501.entry

By Anonymous, at 9:58 AM

Anonymous, at 9:58 AM

Brian, there's no "renewed" sense of frustration - the site exists because of the frustration. I think that's clear in the "About" overview, so no one should be surprised by it. If they want a generally upbeat blog on MSFT instead, I don't know any from a shareholder perspective - but perhaps they exist. It's also increasingly tough finding ones on the general or product side (e.g. Microsoft Watch under Wilcox now reads more like Slashdot), but I'd recommend:

InsideMicrosoft

on the product side. WRT not expecting a glowing review of the stock here, where would you go to find that based on demonstrated track record? WRT my reasons for not selling, the short answer is because I'm a LT holder by nature and believe the stock is worth substantially more than is currently reflected. But I may finally bail, or MSFT might turn things around and get the stock back on track. In either case, this blog will likely then cease. WRT what I would change if I could, an excellent question. Maybe I'll do a "enthusiastically negative" post on that in the future. :-)

By MSFTextrememakeover, at 2:52 PM

MSFTextrememakeover, at 2:52 PM

So, what is the level when MSFT starts looking irresistibly ripe for a buying spree? $20?

By Anonymous, at 3:00 AM

Anonymous, at 3:00 AM

What do you think about the stock now? How is it possible that you write long notes about how the stock is busted and how you told us so - but when it bounces back and actually outperforms, you are silent. I guess you just move on to the next topic/rant.

By Anonymous, at 2:21 PM

Anonymous, at 2:21 PM

Post a Comment

<< Home