Wimpy talking to Popeye? No, although the wimpy part has some applicability, and there is a certain undeniable resemblance if you remove the hat and add some glasses. Actually, I'm talking about the message that our fearless CEO (and CFO, although he spent most of the session polishing his Marcel Marseau impression) delivered to Wall St. analysts today. If interested, here's a link to the webcast. And while Popeye famously said "Frien's is the mos' importink thing on eart', neither Steve nor Chris had many friends in attendance. Instead they faced analysts, who were wondering why exactly they should shell out for that hamburger today given that MSFT's post-'00 record of delivering "Tuesday's" promised payment via earnings acceleration has proved to be as elusive as finding WMD in Iraq.

Needless to say, analysts - like long-suffering shareholders - walked away without a satisfactory answer. And while my pre-webcast choice for advance-prediction sweepstakes winner was analyst Brent Hill:

Wednesday also saw a note from Citigroup analyst Brent Thill raining on the parade, with Thill writing that the Thursday event "will be nothing more than a cheerleading session around Vista/Office 2007," with no substantial plans or expectations will be announced.

It turns out that even he was too optimistic since there wasn't much Vista/Office cheerleading either. In fact, if you missed the webcast but pulled up the MSFT quote AH and thought "huh?", in large part that's a reaction to Ballmer using this opportunity to tell analysts they were being "too bullish" for Vista sales in FY '08 - but I'll come back to that later and provide more detail.

So what did analysts get? Well, after warming up the room with a joke comparing last year's staff infection in his foot to the infection that befell the stock around the same time (ah, what leadership, judgement and maturity), he moved on to more weighty matters. For example, there was a discussion of the 5 "pillars" for MSFT's continued success (or future trouble if handled poorly):

- People

- Innovation (well, not that kind necessarily, but you know)

- Investing Broadly

- Live transformation

- Long-term oriented

I won't bore you with the details, although they were good for some comic relief. For instance, while describing the perils of investing too narrowly ("one-trick pony" - read GOOG, though that was left unstated, of course) or too broadly, Ballmer noted that:

Some companies try to do too much, invest too broadly in too many things for too many people and not doing any of them very well.

Hmm...who does that sound like? It got funnier when he later said that MSFT's approach was the "broadest in the marketplace". Er, Steve, could you reconcile your first comment with your second please? Thx. It happened again on #5 - long-term oriented - when after citing IBM as an example of someone who didn't persist when they should have (routers, PCs, etc.), he explained the problem of being too long-term:

Some are too persistent, don't get accountability and wind up in some sense actually hurting shareholder value by staying with things too long.

My bet on the company that every analyst in the room was thinking for that example? MSFT.

Ballmer then dropped the bomb shell which resulted in tonight's AH selloff: analysts estimates for Vista sales in '08 are too aggressive. Note to MSFT's absentee Board of Directors: when your CEO and CFO address the financial community, it's meant to be a positive catalyst for the stock. Perhaps that should be your first clue that all is not well? Anyway, getting back to it, what Ballmer really said is that "some" estimates were too high. In the Q&A later, after a ridiculous game of cat-and-mouse, he further clarified it as primarily on the top line with "no huge disconnect" on the bottom line. That didn't halt the initial negative AH stock reaction, and it won't halt the headline media reports or tomorrow's likely market action. Nevertheless, it is a significant distinction. Ballmer's main point was that expected Windows growth in '08 should be just a little better than PC growth rates in the developed world (not up to 2X that, as some analysts were apparently predicting - fwiw, none that I've seen, but there you go). He further stated that the bullishness being reflected in MSFT stock but not other PC-related stocks didn't make sense (which sounded distressingly like a "Sell" recommendation), and that a new version of Windows was "primarily a chance to sustain the revenue we have" (I thought I actually heard the stock drop on that one in real-time, but perhaps it was a delayed reaction to his earlier statement that margins moving forward would - at best - stay the same). BTW, there was some good news in this section and that was that MSFT is going to hold the line on spending by and large (and subject to change). As some analysts, like Goldman's Rick Sherlund, had been speculating about another major increase in Op Ex, this should do something to mitigate the downside fallout from the Vista news.

Minutes ~20-41 passed with me sticking toothpicks in my eyelids to try and keep them open. Given that this was the section where Ballmer laid out his 9 high-visibility areas of future growth (as well as 6 less-certain ones), you'd think I would have been captivated. I wasn't. If you're interested, Mary Jo Foley has a good write up here. Alternatively, if you want the condensed version, it's primarily "milk the existing cash cows in the installed base". The list does raise some sobering points though, not the least of which being that after decades of investments in emerging businesses and $10B's spent, the top 5 areas of perceived future high-visibility growth are all dependant on the legacy cash cows. For example, after an unbelievable $5B of losses to date, Xbox is ranked at just #7. Sorry Steve, explain to me again why this was "one of the greatest creations of shareholder value ever"?

The 6 less-certain areas of growth didn't yield much of interest either. Although again, its sobering to see that the beleaguered ZUNE (which recently saw its VP leave to spend "more time with his family") is ranked ahead of IPTV, despite more than a decade of investment in the latter (which, if I recall correctly, included ~$10B in write-offs alone attributable to a failed strategy of telecom/cable ownership stakes). Hmm...either someone's hoping for a stellar turnaround in ZUNE, or that already "small amount" that Ballmer said was going to turn into a lot of money when multiplied by every TV on earth, just got even smaller. One thing that was new is the elevated focus on healthcare. Ballmer now sees this as a good market, which may experience an "explosion" in IT. I guess that explains why say, Oracle's Larry Ellison was looking at potential acquisition targets that included Cerner just four short YEARS ago. And some people think MSFT is slow on the uptake. :-) Kidding aside, this focus makes sense and is long overdue.

About 42 minutes in I woke up again, salivating like a Pavlovian dog hearing its bell. That's because the discussion had turned to future growth versus the competition and what investments MSFT has to make in order to keep up with "the speed and rate of the fastest growing companies in our industry" (AAPL, GOOG, CRM being the examples cited). Huh? Er, Steve, when's that going to start far less go into sustainment mode? I guess he's talking about the really long-term future again - as in Buck Rogers. He never really addressed that apparent disconnect, but I suspect it's a combination of a longer-term view and the oft-used "we need to maintain our share of the industry's overall profit" argument. Of course, the market doesn't really care how MSFT does relative to the entire industry per se, but rather how it does relative to itself and major competitors (which, in most cases, are competing for the same investor $). All that aside, the disappointing aspect here (and in the presentation generally) was the continued failure of current MSFT leadership to deal head-on with the track record of existing emerging business "bets" that collectively are still unprofitable despite massive $ invested for (in some cases) decades, while simultaneously making the case for doing even more. This imo says it best:

Microsoft has always held the view that if they invested enough money and maintained enough persistence they would eventually be successful,'' said Ursillo of Loomis, Sayles. The track record on that approach is mixed at best.

Okay, I know I'm running long and mercifully we're at the final Q&A. Sandford Bernstein's Charlie Dibona came through (as always) with tough questions on the "Live transformation" and related investment given the non-financial metrics going "sideways to south". Liddell, not one to miss a beat, said "at least you're consistent, so I knew that question was coming" - and then proceeded to avoid actually answering it. Earth to Liddell: do you really think this was on just Charlie's mind? If not, might it have been an idea to come prepared to answer it? Anyway, suffice to say that the only "transformation" occurring after that one was MSFT-holders turning into ex-holders in the AH market.

Another good exchange, was when an unnamed MSFT investor asked about why long term investments to date hadn't yielded more success especially in Search/Advertising (go figure), why MSFT wasn't doing something more on the branding side to combat Apple's ads, and whether MSFT was getting maximum bang for its R&D $ vs smaller rivals like Salesforce.com who spend far less but can still land large accounts like DELL and CSCO. Ballmer debated the Search and CRM ones, saying they'd done quite well in his view given a later entry. Er, who's fault was that Steve? On the Apple one, he gave a semi-compelling answer that the $200M or so required to combat it didn't make great financial sense when viewed against the likely unit sale pick-up. While explaining himself, he hammered Apple's worldwide lack of marketshare pretty heavily (which should get the MAC zealots and media riled by tomorrow), and seemingly couldn't make up his mind on whether they had or hadn't grown marketshare (at first saying they "really hadn't", and then later explaining that the reason they "had" was the lack of competitive high-end Windows-based laptops - which in his opinion will be addressed shortly).

So that's it. Could it have been worse? Yes. Could it have been better? Unquestionably. Is the stock going to take a hit? Probably. Has the fundamental outlook changed that much? Not really. Could some of this be MSFT's normal talking down of expectations so they can beat them later by a penny or two? Possibly - although the seemingly definitive statement that current operating margins are as good as it gets, could cause some long-term major holders to seriously reevaluate their positions.

Finally, what can I say about Ballmer? Beyond questioning, as I have, what content was included while leaving major issues - like investment track record to date - largely unaddressed, I have a real problem with his tone and attitude. The word that comes to mind is flippant. I'm sure that's not his intention, but it nonetheless seems to be the result. You get almost no sense that this is the CEO of a publicly-traded company who is accountable to his Board and shareholders. There's almost an underlying sub-text that screams "we're going to do what we're going to do, it's going to take as long as it takes, the stock can do whatever it's going to do in the meantime, and if you don't like it, tough". If MSFT's past track-record of investment -or more recent record of execution - were stellar, this kind of focus and long-term approach might actually be admirable. But in light of the BIG unresolved question marks surrounding the former - and embarrassing realities of the latter - it comes across as tone deaf, out of touch, and even reckless. Bottom line, putting aside the larger question of Ballmer's overall suitability for CEO and obvious failure to drive the stock on his watch, there's a reason the stock sells off virtually every time that he talks to financial people. So what's the "first rule of holes" again? Oh right, when you find yourself in one, stop digging.

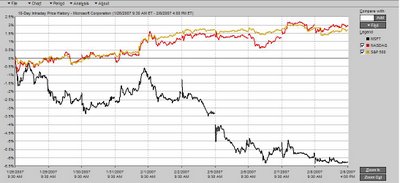

Update: The stock is tanking as expected. So high fives all around to the team in Redmond for accomplishing your apparent go-in objective for yesterday's meeting. BTW, why do you appear to actually favor a permanently broken/range-bound state for the stock again? Anyway, here's a quick round up of some representative coverage:

Update #2: Gotta love the quote in this one - and from a company with an "investment banking relationship" with MSFT no less (or maybe that explains the attempt at damage control):

Ballmer did a poor job of communicating realistic expectations about Vista growth," wrote Credit Suisse analyst Jason Maynard. "He suggested that a few sell-side models were too aggressive on this front. Unfortunately, the message came across to many that Ballmer was trying to talk down consensus Vista revenue estimates, rather than just a few outliers.

A "poor job of communicating"? Steve? Tell me it isn't so! But okay Jason, where's the harm? Oh, a one-day $7B destruction of shareholder value so far? Well hey, everybody can have an off-day. [cue Daniel Pewter's "You had a bad day..."]