Q2/07 Earnings

Sorry for the delay - I was flat on my back for most of the past week with the worst flu of my life. You know things are bad, when you're munching extra-strength Tylenol like they're bar peanuts and yet your head still feels like it's going to explode.

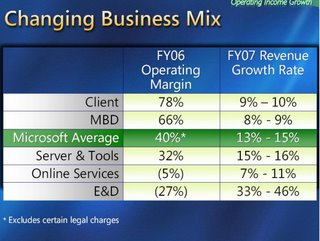

Getting back to the quarterly report, it was a pretty good one. In fact, from a top-line perspective, it was very good. Sure, the adjustment from the technology guarantee program did a pretty masterful job of obscuring that fact. But that was expected. And yes, operating costs also came in hot - which hurt earnings. But that shouldn't have surprised anyone given that we knew Xbox 360 sales would figure prominently in the mix (although I'm less quick to ignore the 23% increase in General and Administrative expenses which, imo, simply underscores MSFT's out-of-control spending). Other's seem to have a different take on the quarter. For example, Joe Wilcox in his summary characterizes it as a "minus". That strikes me as uncharacteristically simplistic and inaccurate of him. But then, of late, he and Ziff Davis seem to be on a personal jihad to alienate their historical reader base. Joe, here's your first big hint: it's not that the $ weren't booked during the quarter, they just weren't recognized. That's a non-trivial distinction. Adding back the deferred $ from the guarantee program, MSFT revenue was up 20% on the quarter. That's the best top-line growth MSFT has had in years. Better yet, the subsequent conference call showed strength across all "core" segments, with uber-successful Servers finally getting a helping hand from better than expected take up in Client and Business.

Of course, it wouldn't be a MSFT earnings call without some disappointments. These came in the form of downward guidance for Xbox console sales through year-end (12M from 13-15M), and downward guidance for Online (from 11% growth on the year to 3-8%. Gee, I wonder if it will be closer to 3 or 8?). Hard to say what to make of the former. No doubt they stuffed the channel over Xmas and are now looking at considerable inventory that needs to be bled off. But perhaps they're finally getting smart and rather than cutting the price post-Xmas and losing every more $, are prepared to stick to their price and simply run out the timeline. Since I'm no particular fan of the Xbox business plan (oxymoron?), anything that reduces the losses here is okay by me. Moving over to Online/Search, what can I say? Unexpected? Absolutely not. Brutal? Yup, with a capital "B". Indeed, it was SO bad, that we even got an [almost never heard in the wild] executive admission of failure and dissatisfaction from CFO Liddell, following a question from Sandford Bernstein's Charlie Dibona (one of the few analysts who consistently dares to ask tough questions):

On the search side, you are correct that we lost market share certainly relative to the independent assessment during the quarter, and are clearly not happy with that.

I'm not a search expert, but it's hard to see how MSFT's efforts since they supposedly "got serious" about Search, have been anything other than a dismal failure. Sure, their actual search capability has improved - markedly so - but who cares when they continue to lose share hand over fist and grow at fractions of even the market? And this isn't just vis a vis GOOG or YHOO. I mean, when Ask.com can grow nicely and gain share and you can't, that should be a pretty big clue that you're on the wrong track. I'm also wondering when we should expect to see some results from former Ask CEO Steve Berkowitz, who MSFT hired? It was very uncharacteristic of MSFT to go outside the company and get someone with knowledge and a track record of success. Normally, they seem to prefer in-bred incompetents. As such, I applauded it. But shouldn't we be starting to see some positive results by now? Or is Steve likely nearing his frustration point at no being able to move the ship faster? Meanwhile, you'll be glad to know that MSFT is "taking a long-term view", which you should recognize by now as MSFT speak for "we intend to continue on our chosen path, no matter how unsuccessful or financially-retarded that appears to be". To that end, MSFT is building yet another $500M data center to keep up with rival GOOG. Given that GOOG can actually monetize its "investments" whereas MSFT seemingly can't, I'm sure they're quite content to let MSFT match them data center for data center. At some point, although [sadly] no time soon, MSFT is going to figure out that it can't buy its way to success in Search - or any other business - and is going to have to earn it instead.

Anyway, that's about it for the quarter. The issue for the stock is that the recent run doesn't leave much immediate upside given current earnings. MSFT's biggest problem continues to be the lack of acceleration in the latter. Current management wants you to believe that this year's massive costs are an anomaly, which will eventually subside leaving a clear path to drive the bottom line. That hasn't been true since '00, and I'm not at all convinced we're going to see it now. Indeed, where earlier I got a sense that, post-launch, MSFT would finally take a chainsaw to its bloated headcount, I didn't get that sense AT ALL from the conference call. So, do the math. With consensus EPS next year of $1.67 and a market P/E of say 20, you get a stock price of $33.40. That's not exactly a return that's going to bring tons more money off the sidelines. Could EPS go up? Sure, some analysts are saying there's .10-.15 of potential upside. So that's $36.40. Could the market decide to award MSFT a higher PE now that its massive Vista screwup is behind it? Possible (in fact the current P/E is ahead of the market), but the failures in Search are likely to remain front and center, thereby keeping the P/E multiple in check. Bottom line, based on the numbers, we shouldn't expect much more upside until such time as MSFT gets serious about driving earnings. Of course, leaving aside the numbers, there's always this savvy investing premise - offered by a portfolio manager no less:

Microsoft underperformed the market for so long, now that it's moving, it's like an oil tanker -- hard to stop," says Alan Lowenstein, a portfolio manager with American Fund Advisers.

LOL, an "oil-tanker"? Now, I'll admit that for much of the past few years, MSFT has looked like the Exxon Valdez, complete with incapacitated leadership. But somehow, I think I speak for most investors when I say that we need a "Great White Shark" not an "oil-tanker".