Growing Shareholder Value? Yeah, not so much.

I came across this presentation, by MSFT CFO Chris Liddell, while doing some unrelated research. Here's the transcript and webcast. Given the subject matter, I'm not sure why I missed it at the time (directly or via the media). Nevertheless, it's worth a read/review.

Liddell starts out on a scary note:

I also like to think about that I've helped bring the investor perspective into the company, and talk about perspectives like shareholder value.

You mean that up until a couple of years ago, it didn't exist? That won't come as a complete surprise to many holders since '00, but it's yet another data point supporting how disconnected MSFT's leadership team is from their actual core mandate of running the company to increase shareholder (i.e. owner) value. Luckily, Liddell gets back on track and moves to the heart of the matter:

I talk to people about how we can drive revenue growth, both in the short and the long term, how we can translate that revenue growth into operating income growth, so what's our margin structure and what are the investments we're making in order to drive income growth; how we drive earnings per share growth, so how do we take our income growth and drive it to the bottom line, and the number that you would be most interested; and then lastly, what can we do from a cash flow point of view and in terms of managing some of the other levers that we have to impact earnings per share growth over the long term to drive shareholder value.

Unfortunately, he goes on to largely ignore answering those critical bottom line issues adequately.

The early part of the presentation is self-congratulation for the job done on growing the "core" businesses these past years. That's deserved imo, but mostly because of the failure to get Vista out (which makes the growth achieved with mostly the same ol', same ol', more impressive). There's also some reasonable detail on how MSFT hopes to grow these businesses longer term. Then comes mostly fluff on how they plan to grow their emerging businesses in Entertainment and Online. For example, you gotta love the detailed strategic thinking captured in this slide:

Somehow, I don't think this was crafted by a Wharton MBA. I also doubt that it instills fear in competitors like GOOG/YHOO or, more importantly, convinces investors that MSFT has a well thought out, winning, strategy here. Of course, simple though the plan may be, that Online and Entertainment business goodness (?) requires lots of investment, which comes at a steep price:

However, Chris et al think "a combination of all of those factors are the ones that we believe in the future will drive a revenue base in the online area". Ah, at least there might eventually be a "revenue base". Sadly, there's no mention of profits - but I'm sure that must be an oversight. Net net, how very reassuring. NOT!

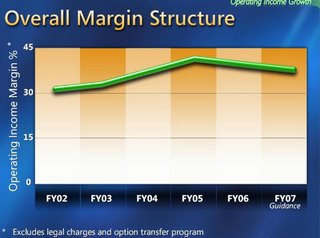

Inexplicably, Chris wants to remind you that, had they not made these investments, overall margins would have been better:

Um, is that meant to inspire investor confidence in the leadership team and their investment choices? After all, why is it that GOOG, Apple, Nintendo, [insert pretty much any other top-tier tech company here], can consistently invest far less, and yet monetize it via significant revenue and profit increases far faster?

The slide-deck "pièce de résistance" though, is this one, meant to capture the glowing history of issuances vs repurchases, and setting the stage for the subsequent "money returned to shareholders" finale:

That's a beautiful thing, right? After all, buybacks are trending higher while issuances are trending lower. Er...not quite so fast. While the trend is decidedly positive, do the rolling math - which MSFT conveniently avoided: Total issuances: 1,815M, total repurchases 1,972M. So, the staggering amount of shareholder cash spent on buybacks over this 7 year period ($43B since '02 alone) has reduced shares outstanding by a whopping 157M shares.

In other words, the vast majority of buybacks to date didn't benefit shareholders directly. Instead, they merely avoided the additional dilution that would have occurred had these massive payments to insiders been allowed to further increase shares outstanding. Meanwhile, the stock grossly underperformed all major indexes, thereby negating the excuse that that payout was justified by results on behalf of shareholders. It is an absolute embarassment - not to mention insult to shareholder intelligence - that MSFT continues to grossly misrepresent the true nature, impact, and principal beneficiary of the buybacks done to date using what was/is, after all, our cash to begin with.

The presentation ends with a review of historical dividends paid, while omitting the fact that MSFT's dividend badly lags even the S&P average, far less the DOW 30 (of which MSFT is a member). Finally, nowhere in the ENTIRE presentation is a chart showing the performance of MSFT's stock over this period (for reasons all too obvious to shareholders). After all, why would a discussion entitled "Growing Shareholder Value" want to focus on that?

Liddell appears to be sincere in his focus on shareholders, and this isn't aimed at him directly. However, MSFT's current leadership team needs to stop playing hide-the-pea shell games with investors and misrepresenting money "returned" to them that in fact went to insiders (with a disproportinately large share of that going to senior management). Instead, they need to be honest with shareholders, and start delivering meaningful bottom line earnings acceleration (not just talking about or promising it) that will drive the stock and create realizable shareholder value (i.e. share price appreciation). You know, like they've been paying themselves as if they were doing, while the lesser-paid teams at Apple, Google, etc., have actually been doing it?

7 Comments:

Excellent post, but it's "piece de resistance." There's a downward facing accent on the "e" in "piece" should you be capable of figuring out how to do that in HTML.

There was a note from some investment house today that the E&D business will show 3B+ in revenue in Q2, making it Microsoft's #2 business (after the MBD...Client is artificially decreased this quarter because of the buyback). OK, at what margin? (I am guessing very slight positive, for only the 2nd quarter ever.) But the bigger picture is: the highest margin businesses are tapering off in growth. The negative margin businesses are growing faster. If you want to plan for long-term growth, you have to make these kinds of investments.

That said, comments about the leadership's competence in creating and executing a strategy for these new businesses must be questioned. And I particularly think the online business is one of the most tragically mismanaged businesses in the history of any business anywhere in the world. Were it not for the WinOff monopolies, most of MSN would be back pulling espresso at Starbucks where they belong.

By Anonymous, at 4:31 PM

Anonymous, at 4:31 PM

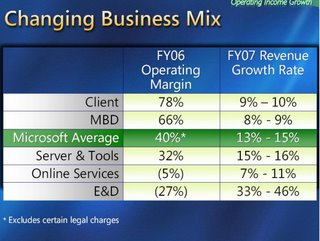

It's been a long time since I took my last accounting class (and I didn't do that well, anyway) but referring to the slide titled "Changing Business Mix," it shows E&D running a 27% negative margin (i.e. losing money hand over fist) and a 33-46% revenue growth rate.

Does that mean MSFT will be losing money even faster, assuming the margin stays the same in Y07?

e.g. If you make $100 revenue, and your margin is (27%), then that means it cost $137 to produce whatever it was that you sold and you lost $37 on the deal.

Now if you increase the revenue to $140 (40% growth) and percentage margin stays the same, whatever it was that you sold cost $192 to produce. So, now you lost $52.

Can you either correct my math or tell me why that's a good thing?

By Anonymous, at 5:25 PM

Anonymous, at 5:25 PM

Good post...this will take some time to think about...

By Anonymous, at 7:09 PM

Anonymous, at 7:09 PM

You're just now realizing that curiously our stock buybacks seem to get media attention in the fall time frame, when we're handing out stock awards like soup in a soup kitchen?

I haven't done the math, but I've always assumed our buybacks offset stock awards for the most part. Your 157M number seems to corroborate that.

By Anonymous, at 1:20 PM

Anonymous, at 1:20 PM

"Can you either correct my math or tell me why that's a good thing?"

It's obviously not a good thing - at least short term. Current management likes to focus on revenue growth (now that they have some again), or point to top line growth since '00 (which is reasonably impressive). What they don't want to do, is focus on the fact that most of that top line growth has been profitless, in large part because of the massive losses incurred by the emerging businesses (the rest being legal settlements, out-of-control headcount increases, and extremely generous payouts to insiders). When backed into a corner to discuss profitability - and that's unfortunately what it normally takes - they invariably give some variation of the theme "you should trust us given our track record". Of course, even a cursory review of the latter shows that while progress has occured in reducing losses, the general record of net new business development is ATROCIOUS. Indeed, the only real success MSFT has ever had in this area is Servers - which is majorly successful (thank God - since Windows and Office growth is anemic). Of course, w/o minimizing the effort there, it did leverage the success of Windows on the desktop (some detractors and courts arguing illegally so) - which isn't the case with most of the others.

By MSFTextrememakeover, at 1:50 PM

MSFTextrememakeover, at 1:50 PM

Another point about the stock (issues vs buy-backs). The mix of who get the stock has changed dramatically. Previously, the vast majority of employees were beneficiaries of the stock dillution. So, while it was still a cost to investors, they were at least getting the benefit of a happy, productive workforce focused on protit growth at all levels of the company.

Lately, the 900 Partners get the bulk of the stock issued, and the people actually building the products fight for scraps. I don't think it's mere coincidence that the company is having so many execution problems. The swtich from rewarding everyone to rewarding only the executive crowd correlates pertty well with the decline in productivity.

By Anonymous, at 7:57 AM

Anonymous, at 7:57 AM

They need to have an executive / partner buyout program - the bench sucks, execs are not executing, and the best ideas being brought forward are "copy apple" and "copy sony". Lets clear the bench and get some really new blood in, and give some opportunity to people who are trapped under the ice. Probably a much better use of shareholder money than the buyback program.

By Anonymous, at 3:34 PM

Anonymous, at 3:34 PM

Post a Comment

<< Home