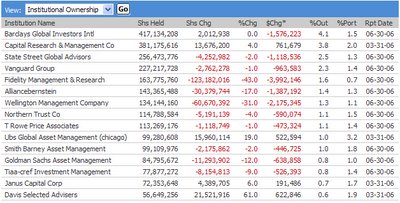

Fidelity pulls the plug on MSFT

It's never a good thing (or vote of confidence in the leadership team) when your heretofore 3rd largest institutional holder decides to unwind 40%+ of their position in a single quarter. Perhaps this explains why management finally decided to get serious about reducing the share count (as several institutional investors were calling for) versus just pretending to (i.e. the last 5 years of buybacks which, for the most part, have been eaten up by ongoing dilution). It also sheds some light on this line from the current tender document:

The Tender Offer provides shareholders (particularly those who, because of the size of their shareholdings, might not be able to sell their shares without potential disruption to the share price) with an opportunity to obtain liquidity with respect to all or a portion of their shares, without potential disruption to the share price and the usual transaction costs associated with market sales.

Now, while you and I might view our holdings as substantial, let's not kid ourselves that selling them would materially impact the price of a stock that trades an average 73M shares per day. So the translation here is: if you're Fidelity (or some other like-minded large holder), please don't dump the stock on the open market and tank the price like you did last quarter - just sell it back to us instead.

Let's see if I'm following this... Management has done such a ridiculously poor job of executing and driving the stock over the past 3 years, that major investors want to dump their position. So rather than address the reasons that investors are fleeing, company leadership (who supposedly aren't focused on the stock at all, far less its short-term direction) will use our money [company cash] to buy out the largest squeaky wheels in the hopes that that will avoid, at least temporarily, the stock falling further? Here's an alternate idea: why don't we save our cash, throw out the underperforming management team, and replace them with folks who can execute such that large investors not only keep holding, but - gasp - actually want to buy more MSFT?

Now, like anything, there's a silver lining. Assuming that MSFT ever gets its act back together (I know, big "if"), then these major folks who are dumping now (and in many cases at historical lows for holding MSFT as a result), may be encouraged to buy back in - thereby providing additional fuel for any subsequent upside move. And of course, there are at least some individuals with strong track records who see opportunity where others seemingly don't:

That's somewhat encouraging, although it's not going to do much short-term, where MSFT continues to do nothing while the market rallies strongly. And if you're hoping that MSFT's plunge-protection team is going to be out in force to defend the stock following the tender's close on August 17th, think again - at least for ten days:

However, Rule 13e-4(f) under the Exchange Act prohibits us from purchasing any shares, other than in the Tender Offer, until at least 10 business days after the Expiration Time. Accordingly, any additional purchases outside the Tender Offer may not be consummated until at least 10 business days after the Expiration Time.

Oh, and who's one of the two "Dealer Managers" for the tender? Why Goldman Sachs of course. So expect to see Sherlund out defending the stock if it takes a substantial dip in the days ahead...

2 Comments:

Amen brother/sister. Nice analysis and info.

By Anonymous, at 3:37 PM

Anonymous, at 3:37 PM

Fidelity is phasing out of Microsoft internally too. New company-wide tech guidelines released in August prohibit the use of .NET for new development except in very specific circumstances, after review by an architecture review board, and so on. Java is now the way. This was a little surprising since there is a lot of .NET and Microsoft stack scattered throughout the company... but I guess if they have lost confidence in Microsoft's management (=> sell shares at current lousy price b/c that's as good as it's gonna get...) then it's only logical that they would also lose confidence in Microsoft's technology platform. Not hard to see why, given the ongoing bloat/security/delay issues from Microsoft's increasingly counter-productive strategy of "everything we sell must be integrated with everything else to drive additional sales" and Microsoft's not-exactly-getting-nicer prices or -getting-easier licensing nightmare.

By Anonymous, at 11:35 AM

Anonymous, at 11:35 AM

Post a Comment

<< Home