IPTV potential?

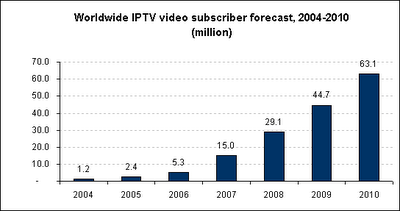

Interesting items from the article include this chart and related commentary:

Those are some serious numbers and go a long way to explaining why MSFT cares about this market. Indeed, I'm left scratching my head wondering why MSFT wouldn't have included ANY of this macro-level detail at the recent FAM? Of course, as MSFT investors, what we don't know is what the company feels it could make per subscriber. Is it $1? $5? $100? Per month? Per year? And what's the timeframe? 1 year? 3 years? Another 10 years? What we do know is that trials are underway at AT&T, BellSouth, Bell Canada, Deutsche Telecom, British Telecom, Telecomm Italia, Swisscom, Reliance and Telecom South Africa. That's a pretty impressive list and hopefully bodes well for future success - whatever that might be.Global IPTV subscribers will grow to slightly more than 63 million in 2010, rising at a stunning compound annual growth rate (CAGR) of 92.1% from 2.4 million in 2005, noted the firm. The IPTV subscriber base will generate more than US$27 billion in overall IPTV services revenue in 2010. While video services will account for the largest portion of these dollars, value-added media services and IPTV operator advertising will combine to represent more than 14% of IPTV services revenue in 2010. Furthermore, across all IPTV services, the corresponding content licensing revenue will reach US$11 billion in 2010.

I guess my parting comment is "Does is really have to be this hard?". Is it really too much to ask that MSFT share directly - albeit at a high level - macro data like this, along with some idea of the magnitude and timing of the specific payoff? To date, the answer is apparently "yes". And then Ballmer wonders why he's losing credibility and why the judgement of himself and his extended senior management team is increasingly being questioned. Go figure.

3 Comments:

You said: "MSFT needs an extreme makeover. Years of past success have made it fat, slow and complacent. It's time to get back into fighting shape. We don't need smaller per se, but we definitely need more effective and efficient. We also need a management team that wakes up every day remembering who they work for - shareholders."

I agree with every single word of your mission except the most important one - shareholders.

If you truly believe this, then I am disappointed in your first stab at blogdom. I will continue to follow you in hopes that you will be converted - as so many softies need to be - to the goal of "working on behalf of the customer" and NOT the shareholder.

IMO, when one works for the shareholder, one goes for the quick buck vs. the ideal, customer-oriented solution. End of pontification.

By Anonymous, at 10:47 AM

Anonymous, at 10:47 AM

Ray,

Apparently you see some inherent conflict between working for shareholders, and doing a good job of satisfying customers. I don't. Indeed, I see the latter as being critical to maximizing long-term benefits for the former. Are there occasional disconnects that could adversely impact customers? Sure - as the saying goes about capitalism generally, "it's the worst system ever invented - except for all the alternatives". And while I very much agree with you that MSFT needs to be more customer-centric, I don't for a minute let that confuse me about who management works for. When it's customer's capital at risk, then management can work for them and maybe the company will even be run on a cost-recovery basis. Until that time, while pleasing customers should be a core focus, management works for and ultimately answers to shareholders.

By MSFTextrememakeover, at 9:50 PM

MSFTextrememakeover, at 9:50 PM

There is a difference between being customer focused and shareholder focused.

I worked for a small private company that ultimately decided to go public. When we were private our discussions were always about what we should be doing to delight our customers. We invested our time, money, and energy in delivering the right product for our customers.

After we went public, everything changed. The discussions all turned to what the analysts were expecting and how to make sure we didn't disappoint the market. We became blinded to the customer and transfixed on the numbers. I never really understood why we changed the focus since before going public we had significantly grown our income and profits every quarter (because we took such good care of our customers).

Ultimately the focus on the numbers ate us alive. We decided the only way to grow at the pace the market required was to sell to a much larger player. We did that and now the product is a small somewhat ignored cog in a large portfolio of products for that company.

By Anonymous, at 9:22 AM

Anonymous, at 9:22 AM

Post a Comment

<< Home