The recent wave of mostly-positive MSFT news appears to have crested and is being replaced by an increasingly cautious tone. For me, the first signs of this were concerns over comments that Ballmer apparently made wrt R&D spending for 2007. See story here:

If true (and I've seen neither a denial or a confirmation), management apparently didn't learn the lesson from last time they negatively surprised the market with higher R&D costs. FYI, this would represent a further $1.3B above and beyond the amount that put MSFT into a $40B tailspin in April. They say the definition of insanity is doing the same thing over and over but expecting a different result. If once again MSFT is forced to admit that it has seriously understated its '07 R&D spend, then I think management will lose whatever credibility they have left - which isn't much. Additionally, it will almost surely impact earnings in a negative fashion, but back to that in a second.

[Apparently the further R&D increase is false. See update below - courtesy of a reader.]

The R&D concerns were quickly followed by more public whining from several [former] security partners about lack of equal access to Vista's kernel/security console, and threats of possible action by the European Commission. Hot on the heels of that, came news that Vista, which seemed to be firming up nicely, will no longer RTM on the 25th as expected:

Don't know about you, but Allchin's new "pretty good shape" tone sounds a lot less optimistic that just a few short weeks ago and makes me wonder if they've hit some new unexpected bug/issue(s). Adding to these Vista-related ship date concerns, are worries that earnings could take an additional hit due to the anticipated Vista coupon program:

Sprinkle in AAPL's strong results last night, which apparently included a large jump in computer sales, including new-to-AAPL buyers (read: likely Windows converts):

And GOOG's blowout results today (it's up $32.72 currently in AH):

and we seem to have all the makings for this recent upward stock momentum to have ended - or at least stalled temporarily. Worse, take the rumored higher R&D number (and likely negative fallout), the hit from the anticipated Vista rebate program, the likely increased costs associated with making the recent product changes to please the European Commission, rumors of heavy Xbox discounting in Japan as a last-ditch effort to try and salvage that situation, and the fact that buybacks - though aggressive - are unlikely to have secured the shares that would have been retired via the tender (and were needed to make the revised earnings guidance for the year), and there seems to be a growing risk for a relatively weak Q and more importantly, downward earnings guidance for the rest of the fiscal. Now, I don't want to be Chicken Little, but if that happens, especially against the backdrop of AAPL and GOOG continuing to knock it out of the park, MSFT is going to reestablish itself as a laggard - both as a company and as a stock. And if that ends the current upward momentum right around here, focus is quickly going to turn to technicals and talk that MSFT has once again topped out on its now 3-4 year old trading range. The latter would be a green light for shorts.

Let's hope this scenario doesn't play out and that management somehow either manages to dispel these concerns and/or results are strong enough to overcome them. I'm dubious, but also have a hard time believing that management is prepared to risk another post-earning's call implosion just weeks before the annual shareholders meeting. Then again, they've done it before - which is why those November $27.50's puts are looking increasingly attractive as some cheap insurance should another blowup vs blowout be headed our way...

Update: the R&D spending increase rumor appears to be false:

Update 2: Argggggghhhhh! Okay, I'm completely confused wrt what the original R&D guidance for '07 was. Before making my initial post, I checked the Analysts meeting .ppts (where guidance for everything else was given) and found nothing - hence my stated inability to confirm or deny the rumor. Subsequent to that, a reader alerted me that the article I posted had been revised with the seeming impact being to deny the rumor of a further increase. Accordingly, I updated my post and put a strike through comments that no longer seemed applicable. It was still bugging me, so I did some more digging. Specific guidance from MS continued to elude me, but this and numerous other 3rd party sources say it was meant to be $6.2B (which while consistent with the original story's claim of a $1.3B increase to $7.5B, in hindsight makes no sense since the actual for '06 was $6.684B - and we knew it was increasing). Additionally, numerous legitimate media sources ran similar "$7.5B is a further $1.3B unexpected increase" stories w/o posting a retraction (and they says blogs lack credibility). To make a long story short, what I did find was the May '06 Sanford Bernstein event, where Ballmer said "And really I also pointed out that with an R&D budget that's going to come on $7 billion, we could probably afford to do 60 or 70 different things" and later "Now, we spend $6.2 billion in R&D" - which I would take to be his approximation of the '06 spend (I didn't have time to listen to the webcast for context). If that turns out to be the closest thing to actual company guidance, then recent purported Ballmer comments of $7.5B would represent another unexpected increase (albeit $500M vs $1.3B) and once again w/o advance warning to the street. Oh well, my head hurts now, so I'm giving up and going to bed!

Update 3: a potential explanation for Allchin's recent, more reserved Vista comments referenced in this post?

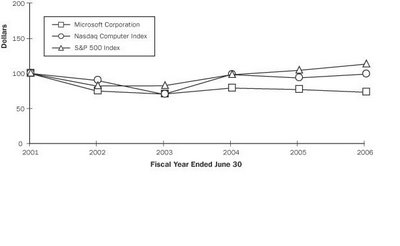

The net message? MSFT has underperformed the S&P 500 index for 5 years now, and the NASDAQ for the past 3. Note that this is despite MSFT assuming dividend reinvestment for the calculation - including, principally, the record-setting but financially-irresponsible $3 one time - and some $40-50B of shareholder-owned cash having been poured into buybacks during that period. Worse, this brutal record of underperformance is getting more pronounced. That might be less obvious from the simplistic and advantageously drawn chart supplied by MSFT. Let's take a look at how the chart would look drawn to scale and w/o including the dividend reinvestment component:

The net message? MSFT has underperformed the S&P 500 index for 5 years now, and the NASDAQ for the past 3. Note that this is despite MSFT assuming dividend reinvestment for the calculation - including, principally, the record-setting but financially-irresponsible $3 one time - and some $40-50B of shareholder-owned cash having been poured into buybacks during that period. Worse, this brutal record of underperformance is getting more pronounced. That might be less obvious from the simplistic and advantageously drawn chart supplied by MSFT. Let's take a look at how the chart would look drawn to scale and w/o including the dividend reinvestment component: