FAM - Ante up, up the ante, or just plain bluffing?

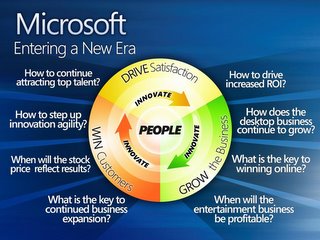

That corresponds with the trading action, which saw the stock tank almost immediately after Kevin Johnson failed to rule out a further delay - although it's hard to believe that supposedly smart people were counting on MSFT to do otherwise given the numerous slips so far and months of development work still left. Of course, even if Johnson had backed the ship date 100% (and he actually came closer than I expected), it's unclear that the content/tone of the FAM would have inspired a buying frenzy. That's unfortunate, because when Ballmer opened with this slide, I was initially optimistic that he was going to deal with matters head on:

These are exactly the concerns that exist and the questions MSFT needs to answer especially re: the stock. And it's the first time I've heard Ballmer even acknowledge many of them. Unfortunately, despite raising them and promising they would be addressed by day's end, most weren't - except indirectly.

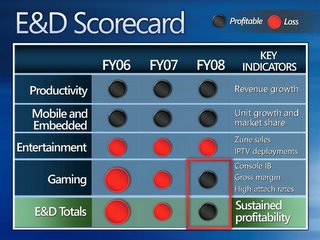

Other slides that caught my eye in a mostly negative way, included:

This was the culmination of Jeff Raikes' extended effort to discuss adjacent markets into which the Information Worker segment can expand. While that's obviously what MSFT should be focused on doing (in addition to building a product that more existing users want to upgrade to), Raikes never explained whether MSFT's entry into these fields could be expected to yield the market growth rate, something more, or less. That's obviously critical since as you can see from the chart above, most are growing at less than 10% - which would appear to put a cap on what can be expected from IW, MSFT's second-largest source of profits. Indeed, this clumsy presentation has already led to at least one media report incorrectly quoting Raikes as saying that MSFT's IW group would have a CAGR of just 7% over the next 3 years - whereas that was his forecast for that entire segment of the overall market.

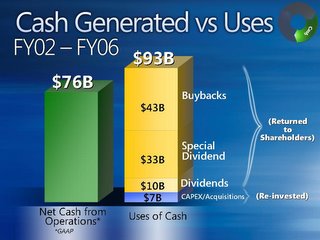

This was CFO Chris Liddell's contribution to show what a great job of forecasting MSFT did in '06. Arguably, it doesn't do a very good job of that at all. More importantly, the takeaway for me is that that while business was much better than expected, MSFT only managed to come in at the lowest end of its EPS guidance. Indeed, Liddell confirmed that given the heavier investments, the latter was only made possible via the increased pace of the buybacks. In other words, w/o the buybacks, MSFT would have missed. Gee, that makes me want to run right out and buy more stock. Not!

What can I say about this slide besides the fact that it burns my butt every time I see MSFT referring to all this money supposedly "returned" to me that never actually was? The reality is this: most of that $43B of buybacks went to avoid dilution caused by insider selling. In other words, it was [shareholder-owned] cash that was hijacked to pay insiders - not money "returned" to shareholders. The $33B special dividend, possibly the stupidest use of funds in corporate history, did accrue to shareholders but tanked the stock $5 before it was all over and took more than a year to recover from. In other words, it mostly benefitted traders not long-term holders. The ongoing dividend does accrue to shareholders, but is below market and far below the DOW 30 average of which MSFT is a member - so hardly praiseworthy. Most important of all, in 2002 the stock was as high as $35. Today, it sits at $24.25. At the end of the day, that's where the rubber hits the road - and MSFT's track record in that regard is simply abysmal.

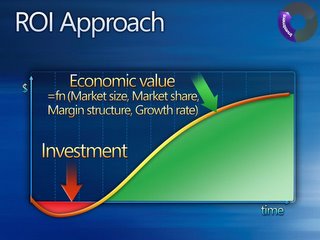

This was seemingly the slide "du jour" and variations appeared in several presentations. If I wasn't a shareholder, it would be comical to see MSFT explaining their unique business investment strategy with what most will recognize as the standard Economics or Business 001 investing chart. As stated above, everyone's aware that MSFT is losing money in various areas and that this is often necessary when making new investments - we don't need a grade-school refresher. The concern is that for MSFT, the curve is the opposite: losses are massive and go on indefinitely, whereas returns are either totally unclear or modest and short-lived. Several presenters suggested that no, MSFT views all investments over a 3-7 years timeframe. But with MSN and Xbox in particular, that's either already been negated or is a contention that seriously strains credibility.

Explain why I'm paying 20 times for a stock that is growing at 10 with a whole lot of investments that are not really going anywhereThat, in a nutshell, is Ballmer's challenge. If MSFT can't find a way to grow faster than 10%, and continues the ridiculous current level of headcount increases and money-losing "big bets" such that income trails even that anemic growth, then MSFT is eventually going to trend to a P/E nearer to 10 than the current 20. For his part, Ballmer took pains to tell us that 85-90% of his investment portfolio is in MSFT. Somehow, that doesn't reassure me.

On a brighter note, Bob Muglia's presentation was right on target - Server & Tools has long struck me as the best run division in MSFT. Kevin Turner's and Craig Mundie's presentations were also okay/informative. Ray Ozzie's was good albeit a little obvious and therefore dull - but seems to have been well received by others. Maybe the fact that someone at the top is now prepared to state the obvious is a positive alone. Frankly, I need to see results versus just words before I can conclude similarly. Finally, while I had some concerns, Liddell's presentation did at least try to deal with some issues head on, and he generally came across stronger than I've seen him on previous occasions - which is a plus. Bottom line, is MSFT anteing up, upping the ante (as they contend) or just bluffing? I don't think the FAM answered that, so only time will tell.